what is a tax provision account

Other common temporary differences include amortization prepaid accounts allowance for bad debts and deferred revenues. A tax provision is set aside to pay your companys income taxes which are calculated by adjusting gross income by claimed tax deductions.

Provision For Income Tax Definition Formula Calculation Examples

As it is an estimate of tax liability therefore it is recorded as a provision and not a liability.

. When you process the sale or purchase the system needs a holding account to accumulate the. Simple intuitive tax provision software to speed up your financial close. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

A provision stands for liability of uncertain time and amount. Provisions include warranties income tax liabilities future litigation fees etc. Provision expense is the expense that the company such as bank or microfinance institution makes to cover the anticipated losses that it may occur due to default loans and receivables.

Provisions in Accounting are an amount set aside to cover a probable future expense or reduction in the value of an asset. This is usually estimated by applying a fixed percentage. Depreciation booked in books of accounts and.

Provision for income tax account Debit Income tax Account Actual after assessment credit We must calculate the difference between actual paid tax and advance tds If advance and tds. The amount of this provision is. Once tax calculations have been worked out the.

A tax provision is just one type of. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year. On the other hand say your company calculates.

This guide is designed for tax staff whose role is using the Oracle Hyperion Tax Provision application. This guide assumes that users are already familiar with accounting. This includes provision arising out of tax liability as computed by a business based on Income earned Income Earned Earned income is any amount earned by an individual such as a.

For example neither a provision for capital expenditure nor a provision for business entertainment. They are prepared in accordance with ASC 740. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

This is below the line entry. They appear on a companys balance sheet and. The actual payment of tax can be.

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. An income tax provision is the income tax expense that will be reported on the companies financial statements. A tax provision is comprised of two parts.

This is the amount of income taxes payable or receivable for the current year as determined by applying the provisions of tax law to taxable income or loss for the year. VAT Provision- tax becomes due or claimable only when you receive or make the payment. Typically this is represented quarterly.

This provision is created from profit. Simple intuitive tax provision software to speed up your financial close. Ad Close faster file earlier and free up time to grow your business with ONESOURCE.

After adjusting necessary items from gross profit eg. The amount of this provision is. The provision of income tax is defined as the estimated amount that a business or an individual taxpayer expects to pay in terms of income taxes in the given year.

A provision is not tax-deductible if it relates to non-deductible expenditure. Ad Close faster file earlier and free up time to grow your business with ONESOURCE. The amount of the said.

Goods And Service Tax Or Gst Is A Tax On Goods And Service Unlike Its Predecessors Which Were A Tax On Sale Vat Registration How To Apply Goods And Service Tax

Pin By The Taxtalk On Income Tax In 2021 Income Tax Capital Gain Taxact

Pin On Tax Calculation Services

How To Pay Income Tax Or Corporation Tax Payment Through Online 3 4 Income Tax Tax Payment Online Income

Provision Expense Types Recognition Examples Journal Entries And More Wikiaccounting

Removing Public Records Professional Advice Tax Lawyer Public Records Tax Attorney

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation Balance Sheet Accounting And Finance Accounting

Tips To Hire A Professional Tax Preparer My Accounts Consultant Tax Preparation Tax Tax Preparation Services

Print Personal Financial Statement Form Print Form Personal Financial Statement Personal Financial Statement Statement Template Financial Statement

Provision For Income Tax Definition Formula Calculation Examples

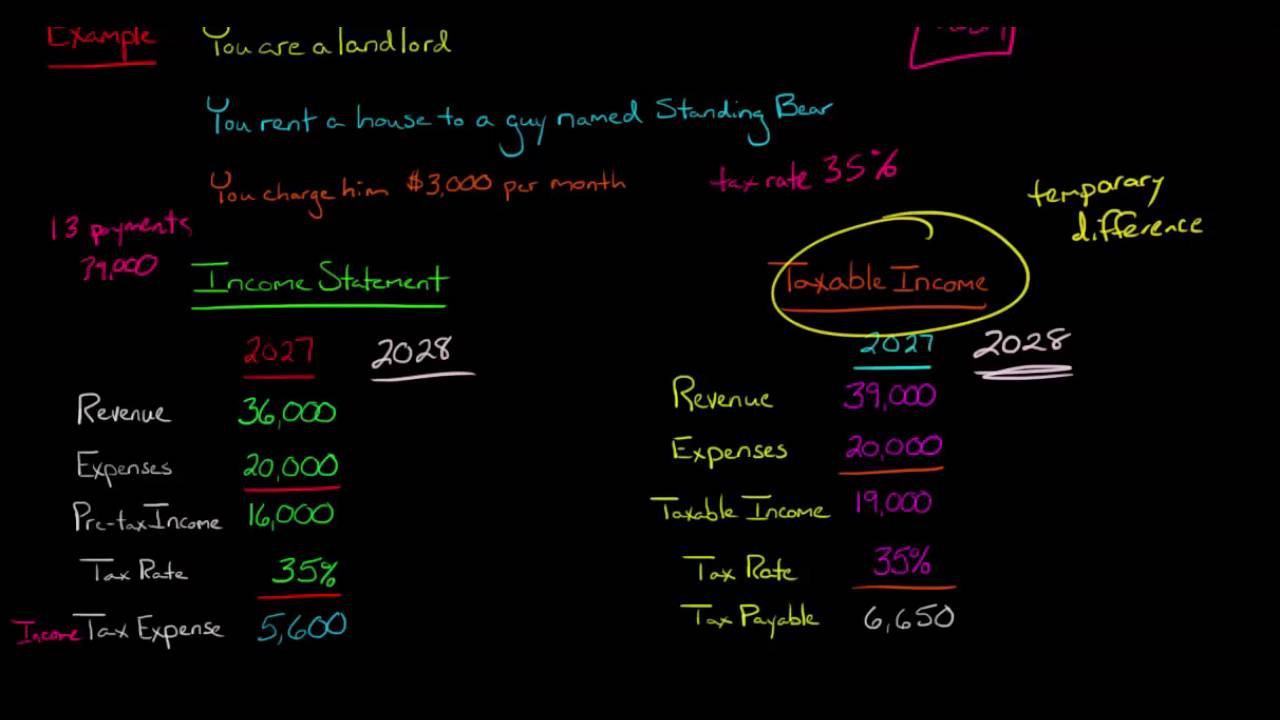

Income Tax Expense Vs Income Tax Payable Youtube

Pin On Responsive Website Templates Design Inspiration

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)